We help our clients to execute impactful strategic and financial transactions....

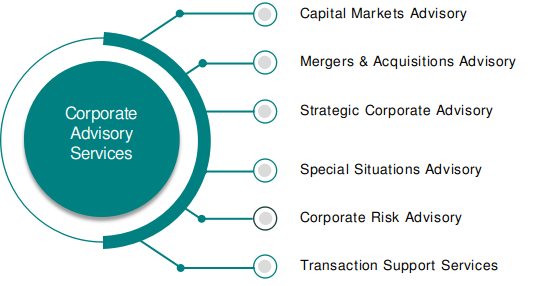

At Intellego, we deliver a comprehensive range of corporate advisory services to corporate clients in all sectors of the economy. The scope of our engagements ranges from short-term transaction support services such as business valuations to longer term strategic transaction advisory mandates such as mergers and acquisitions.

Our corporate advice is bespoke, tailored to the specific transaction objectives/needs of the client to ensure the best possible outcomes. Our regular mandates include deal structuring and execution for capital raising clients, transaction support services

We have a solid track record of successful advisory engagements including some of the leading corporations and financial institutions in Zimbabwe as well as governmental and quasi-governmental entities.

We provide unbiased, professional advice on the best options and optimum structuring of any equity, debt or mezzanine capital raising programme for our clients, who range from publicly listed companies, to private corporates as well as parastatals and other governmental entities. We maintain connections with financing entities and institutional investors both domestically and overseas so as to give our clients the greatest likelihood of success. In any engagement, we work with our clients from the structuring phase through to execution and financial close, ensuring minimum risk and maximum efficiency along the way. Our Capital Markets Advisory Services include:

- Equity, Debt and Mezzanine Structuring– scoping, modelling, valuation, transaction structuring and optimal pricing and terms.

- Public Issuances – Initial Public Offers (IPOs), Seasoned Equity Offers (SEOs

- Rights Issues– structuring and execution for both public and private clients.

- Private Placements – Targeted placement of capital raising instruments.

- Securities Exchange Listings– assisting our clients in selecting and allocating

- Project Financing Advisory– structuring and arrangement of project funding.

As an independent advisory firm, we are able to provide wholly objective and pragmatic advice on strategic merger and acquisition transaction options for clients ranging from corporates to professional investors such as private equity firms as well as High Net-Worth individuals. Our industry research and expertise spans all the key sectors from financial services, mining, agriculture, agro-industrial, energy and real estate to manufacturing and telecommunications. We interact with strategic buyer and financial sponsors and strive for the best possible execution in the context of the environment. Our specific M&A Advisory expertise includes:

- Sell-side mandates– execution of business sales, divestitures and strategic asset disposals.

- Buy-side mandates – defining the acquisition strategy, target list development and specific target evaluation, transaction structuring and execution of strategic acquisitions.

- Management Buy-Outs (or Buy-ins)– transaction structuring and execution.

- Due diligence and negotiations – in support of transaction closure.

We facilitate the attainment of our clients’ strategic investment and financial goals through the delivery of thoughtful and bespoke solutions that are underpinned by our independence and professionalism. Our expertise and experience across various strategic engagements enables us to add value to a variety of transaction situations. Our Strategic Corporate Advisory services include:

- Capital Structure Optimisation– Optimising the capital mix, capital allocation strategy and any associated capital raising programme

- Strategic Options Analysis – evaluating and advising on the financial and business impact of multiple strategic options available to clients.

- Corporate Development Advisory– devising coherent corporate development programs to meet long-term strategic goals and objectives of clients.

- Privatisations Advisory– assisting State-owned Enterprises (SEOs) with transaction planning, structuring and execution.

- Joint Venture & Public-Private Partnership (PPPs) Advisory– We help clients to identify or review potential partners, structuring of terms and negotiation.

Our corporate clients encounter different circumstances and situations at various stages of the business lifecycle including changes in the operating environment that adversely affects their business performance. These situations often require specific interventions to either mitigate against emergent challenges to business continuity or to capitalise on new opportunities at a time when the business is not best equipped to do so. We offer solutions tailored to these special situations and these include:

- Corporate restructuring – investigating problems and assessing the financial and operational strategies available for the client and structuring the solution

- Recapitalisations – reconfiguring the capital structure and raising new funding to get the business back on track.

- Distressed Asset Investing – we assist buy-side clients in evaluating distressed assets and structuring an appropriate transaction. We also facilitate sell-side transaction opportunities by linking up distressed asset owners with prospective buyers.

We assist our clients ranging from banks, insurance companies and asset managers to non-financial corporates, to identify, assess, manage, report and limit the risks they face in the course of their regular business activities or in the context of a specific transaction. Our risk advisory services add much needed value to the overall transaction objectives of our clients. From evaluating the various risk implications of a transaction to regular risk research and rating of transaction counterparties, our input gives the necessary perspective for informed decision decision-making. Our risk advisory services include:

- Financial Risk Management Advisory – establishing financial risk management frameworks that cover the measurement, management and reporting of risks such as credit, operational, liquidity and market.

- Transactional Risk Advisory – identifying the key risks in corporate transaction settings and advising on required terms and/or mitigation measures.

- Risk Rating Services – providing risk rating services for institutional and corporate clients to aid their decision-making with respect to counterparties.

Our suite of transaction support services provides key inputs and advice towards the successful execution of corporate transactions of various types. Our Transaction Support Services include:

- Financial Modelling and Project Appraisals – we provide financial modelling as part of our broader engagement mandates and also as standalone targeted services for specific client projects

- Business Valuations– we provide business valuation services to our clients from independent standalone valuations to broader transaction engagements requiring valuation as a key deliverable.

- Independent Financial Advisor– we can act as the independent financial advisor to complex transactions in support of the lead financial advisor.

- Due Diligence– we conduct financial, operational and commercial due diligence reviews for our clients.

- Share-based Remuneration Structures– we evaluate and review or design employee remuneration schemes such as Share Option Schemes.